Some common examples of liabilities includeaccounts payable, notes payable, and unearned revenue. Recall that the basic components of even the simplest accountingsystem are accounts and a general ledger. Accounts shows all thechanges made to assets, liabilities, and equity—the three maincategories in the accounting equation. Each of these categories, inturn, includes many individual accounts, all of which a companymaintains in its general ledger. This equation represents your company’s reality in terms of its economic resources (assets), obligations (liabilities), and residual ownership claims (ownership equity). From this, you can assess how efficiently your business is turning revenues into profits and absorbing expenses.

Our mission is to improve educational access and learning for everyone.

- Eventually that debt must be repaid by performing the service, fulfilling the subscription, or providing an asset such as merchandise or cash.

- — At the beginning of the year, Corporation X was formed and 1,000, $10 par value stocks were issued.

- First, it cansell shares of its stock to the public to raise money to purchasethe assets, or it can use profits earned by the business to financeits activities.

- Insurance, for example, is usually purchased for more than one month at a time (six months typically).

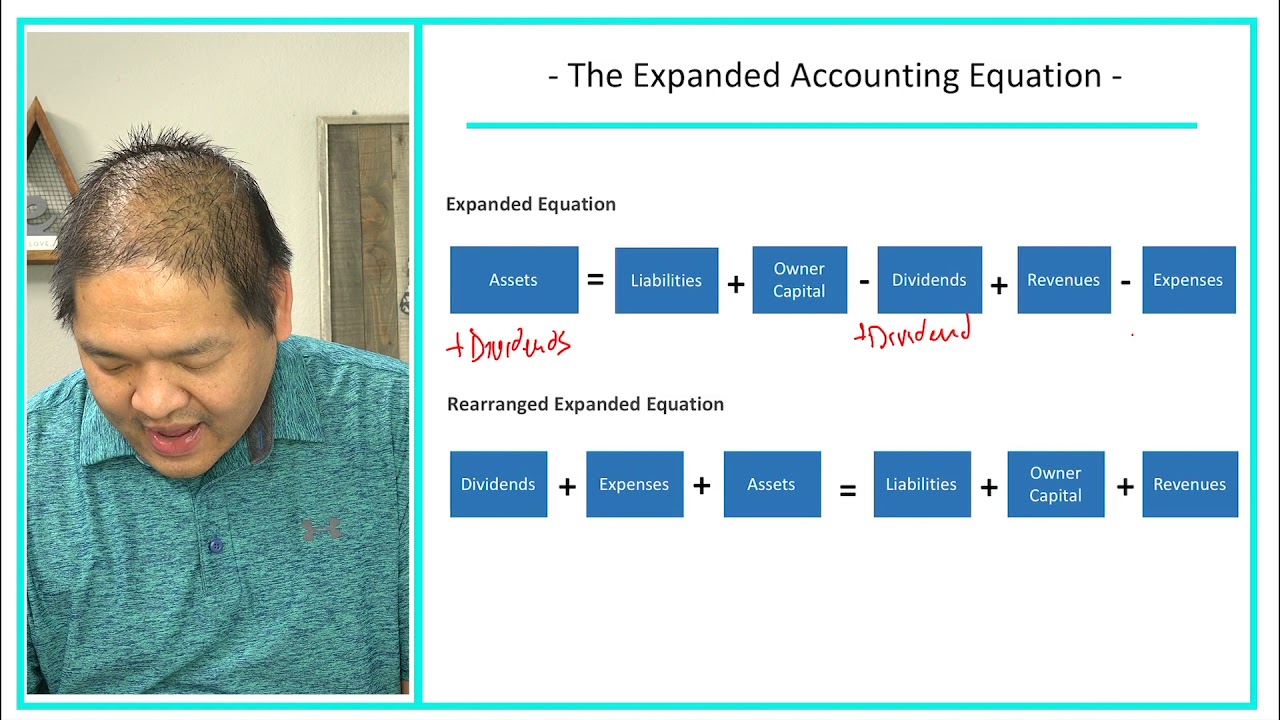

The Expanded Accounting equation is generally different for varying forms of businesses. The equation differs slightly in the case of a proprietary concern, partnership firm, and corporation. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

AccountingTools

Accounts payable recognizes that the company owes money and has not paid. Remember, when a customer purchases something “on account” it means the customer has asked to be billed and will pay at a later date. Equipment examples include desks, chairs, and computers; anything that has a long-term value to the company that is used in the office.

Passive Income Hacks to Cover Tuition Expenses While Studying

Remember, when a customer purchases something “onaccount” it means the customer has asked to be billed and will payat a later date. Equipment examples include desks, chairs, and computers;anything that has a long-term value to the company that is used inthe office. Equipment is considered a long-term asset, meaning youcan use it for more than one accounting period (a year forexample). Equipment will lose value over time, in a process calleddepreciation.

What is the expanded accounting equation?

The information in the chart of accounts is thefoundation of a well-organized accounting system. The expanded accounting equation, on the other hand, presents an in-depth analysis of a company’s finances. Substituting for the appropriate terms of the expanded accounting equation, these figures add up to the total declared assets for Apple, Inc., which are worth $329,840 million U.S. dollars. I hope I was able to explain to you what the expanded accounting equation means, give you good examples, show you how it is calculated, and why it’s important.

Advantages of the Expanded Accounting Equation

Thus, there are resources with offsetting claims against those resources, either from creditors or investors. All three components of the accounting equation appear in the balance sheet, which reveals the financial position of a business as of the date stated on the document. Equity increases from revenues and owner investments (stock issuances) and decreases from expenses and dividends. Another component of stockholder’s equity is company earnings.These retained earnings are what the company holds onto at the endof a period to reinvest in the business, after any distributions toownership occur. Stated more technically, retained earnings are acompany’s cumulative earnings since the creation of the companyminus any dividends that it has declared or paid since itscreation. One tricky point to remember is that retained earningsare not classified as assets.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Some terminology may vary depending on the type tax withholding estimator of entity structure. “Members’ capital” and “owners’ capital” are commonly used for partnerships and sole proprietorships, respectively, while “distributions” and “withdrawals” are substitute nomenclature for “dividends.”

We could also look to XOM’s income statement to identify the amount of revenues and dividends the company earned and paid out. An important thing to remember is that revenues increase equity while expenses and owner’s withdrawals decrease it. So, your regular income-related transactions involve these elements in addition to assets or liabilities. Gain better visibility into your profits and shareholder investments using this nifty tool.

Organizations use the equation to understand a holistic and descriptive financial statement picture. It can be used for deep diving into the organization’s financial transactions, thereby also in the detailed analysis of the financial statements. This results in the movement of at least two accounts in the accounting equation. The amount of change in the left side is always equal to the amount of change in the right side, thus, keeping the accounting equation in balance.