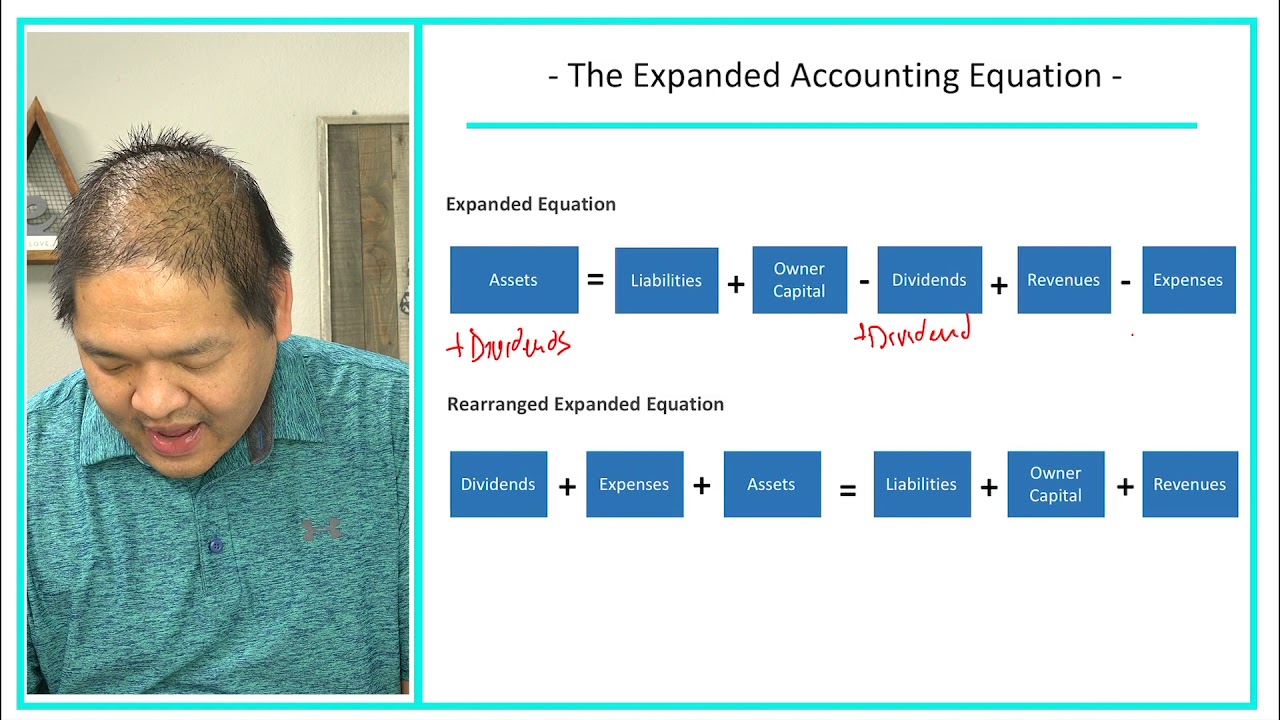

Like the basic accounting equation, the expanded accounting equation shows the relationships among the accounting elements. In the expanded version, the “capital” portion is broken down into several components. The expanded accounting equation is derived from the common accounting equation and illustrates in greater detail the different components of stockholders’ equity in a company. Understanding the expanded accounting equation can be instrumental for any business owner.

Expanded Accounting Equation: Definition, Formula, How It Works

Cash activities are a large part ofany business, and the flow of cash in and out of the company isreported on the statement of cash flows. The accounts are presented in the chart ofaccounts in the order in which they appear on the financialstatements, beginning with the balance sheet accounts and then theincome statement accounts. Additional numbers starting with six andcontinuing might be used in large merchandising and manufacturingcompanies.

What Is Business Flexibility (Explained: All You Need To Know)

For example, a company may have accounts such as cash, accounts receivable, supplies, accounts payable, unearned revenues, common stock, dividends, revenues, and expenses. Each company will make a list that works for its business type, and the transactions it expects to engage in. The accounts may receive numbers using the system presented in Table 3.2. More specifically, this extended equation highlights the particular relationship between the balance sheet and the company’s net income. By breaking down owner equity into revenue and expense components, bookkeepers can report more specific information about where that equity comes from, and what is causing it to ebb and flow. An analysis of a company’s income statement is a key goal behind use of the expanded accounting equation, as it provides a better understanding of profit trends.

What is the famous formula in accounting?

One tricky point to remember is that retained earnings are not classified as assets. Instead, they are a component of the stockholder’s equity account, placing it on cash flow statement indirect method the right side of the accounting equation. When a company first starts the analysis process, it will make a list of all the accounts used in day-to-day transactions.

- Now, let’s say your company generates revenue of $20,000 and incurs expenses worth $5,000 during its first operating period with no withdrawals made by the owner.

- Therefore, the company must record the usage of electricity, as well as the liability to pay the utility bill, in May.

- The expanded accounting equation is derived from the common accounting equation and illustrates in greater detail the different components of stockholders’ equity in a company.

- Another component of stockholder’s equity is company earnings.These retained earnings are what the company holds onto at the endof a period to reinvest in the business, after any distributions toownership occur.

- Diving deeper into your equity section by including revenues, expenses, and owner withdrawals makes you more conversant with your business dynamics.

The equation provides an application when executing simple transactions, including injecting capital into the business or purchasing assets with cash. Let’s illustrate the expanded accounting equation with an example. Diving deeper into your equity section by including revenues, expenses, and owner withdrawals makes you more conversant with your business dynamics. Let the expanded accounting equation be your guide in fraught moments like these.

How do you solve a balance sheet in accounting?

This transaction decreases assets when the cash is distributed and increases assets when the new equipment is received. Let’s take a look at a few example business transactions for a corporation to see how they affect its expanded equation. Let’s look at an example of the “expanded” accounting equation so we can better understand the concept. Beginning retained earnings refers to the earnings that have been kept by the company at the beginning of the accounting period compared to the previous period. By practicing and analyzing your financial statements through this lens, you’ll gain a robust understanding of your business’s financial health—thus steering it toward growth and stability.

It will guide you in understanding related accounting principles and provides a foundation that will help you solve many accounting problems. As you can see from all of these examples, the expanded equation always balances just like the basic equation. — At the end of the year, X ends up with large profits and the management decides to issue dividends to its shareholders. When dividends are issued, cash is disbursed to shareholders reducing assets while the dividends reduce equity. — X hires an employee to start producing products with its new equipment.

As you generate more complex transactions with multiple impacts on various facets of equity, you’ll find that repeatedly employing an expanded accounting equation can offer a comprehensive diagnosis of financial health. The primary difference between the traditional and expanded accounting equation lies in the level of detail provided. In the conventional version, your entries are limited to assets, liabilities, and equity. The expanded accounting equation operates on the principles of double-entry bookkeeping, where each financial transaction your business makes affects at least two accounts.

For a bit of challenge, study the examples above and try to determine what specific items were affected under each element and why they increased or decreased. If you find it difficult, you may refer back to the explanation in the previous lesson. By the way, on this blog, I focus on topics related to starting a business, business contracts, and investing, making money geared to beginners, entrepreneurs, business owners, or anyone eager to learn. Dividends refer to the amount of money paid out by the company to its shareholders. Professionals use it to understand the effectiveness of the accounting policies followed by the organization.

Applying this example to your situation and numbers can give you a comprehensive overview of your business’s financial state over time. You contributed $50,000 from personal resources into the business’s bank account and took a $30,000 loan from the bank. As you dive further into business finance, there is an equation poised to become more than just numbers on a page for you. Before we explore how to analyze transactions, we first need to understand what governs the way transactions are recorded.