A notes payable is similar to accounts payable in that thecompany owes money and has not yet paid. Some key differences arethat the contract terms are usually longer than one accountingperiod, interest is included, and there is typically a moreformalized contract that dictates the terms of the transaction. The accounting equation emphasizes a basic idea in business;that is, businesses need assets in order to operate. First, it cansell shares of its stock to the public to raise money to purchasethe assets, or it can use profits earned by the business to financeits activities. Second, it can borrow the money from a lender suchas a financial institution. You will learn about other assets asyou progress through the book.

Kentucky Secretary of State Business Search (Guide: All You Must Know)

The Financial Accounting Standards Board had a policy thatallowed companies to reduce their tax liability from share-basedcompensation deductions. This led companies to create what somecall the “contentious debit,” to defer tax liability and increasetax expense in a current period. See the article “Thecontentious debit—seriously” on continuous debt for furtherdiscussion of this practice. For example, a company uses $400 worth of utilities in May butis not billed for the usage, or asked to pay for the usage, untilJune. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

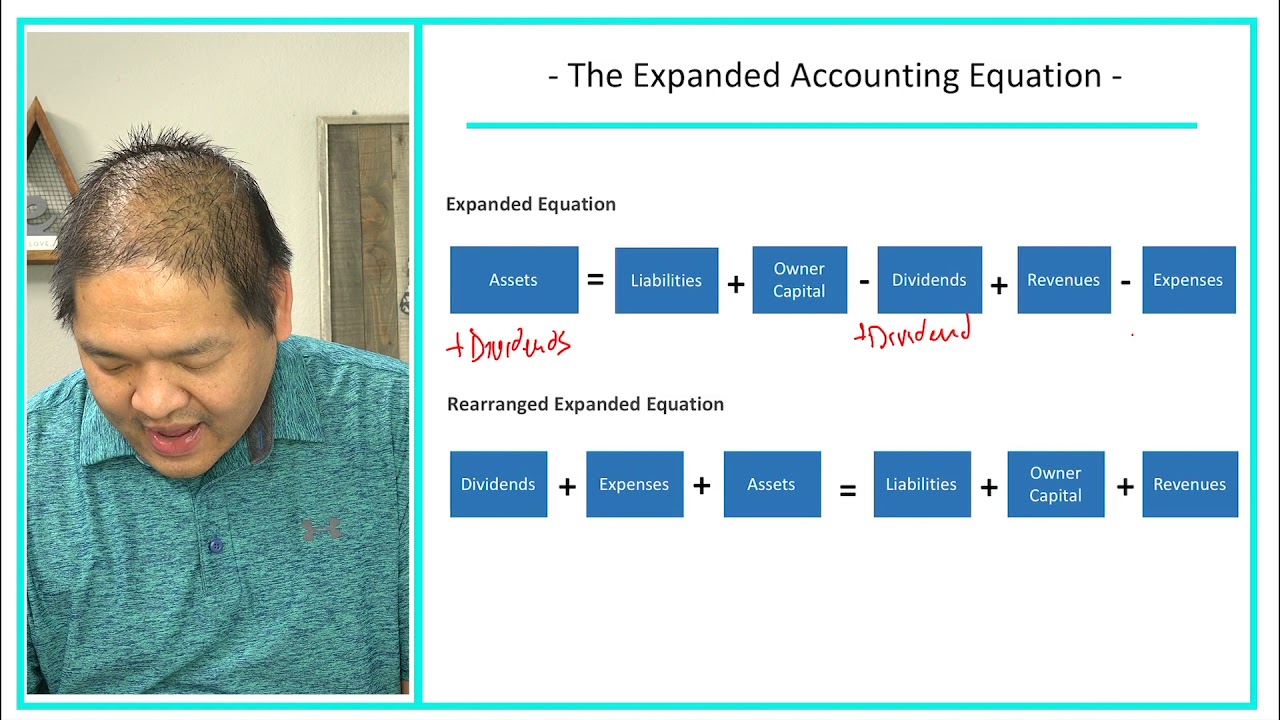

How the Expanded Accounting Equation Works

We begin with the left side of the equation, the assets, and work toward the right side of the equation to liabilities and equity. The accounts are presented in the chart of accounts in the order in which they appear on the financial statements, beginning with the balance sheet accounts and then the income statement accounts. Additional numbers starting with six and continuing might be used in large merchandising and manufacturing companies. The information in the chart of accounts is the foundation of a well-organized accounting system.

Expanded Accounting Equation vs Basic Accounting Equation

It assists in translating complex financial transactions into simple, digestible insights that can inform strategic decision-making. Withdrawing refers to the ‘Draws’ component in the expanded accounting equation. In this context, withdrawal means the owner’s removal of assets (cash or otherwise) from the business for personal use. You might ask what’s the problem with the original accounting equation?

AccountingTools

Net income reported on the income statement flows into thestatement of retained earnings. If a business has net income(earnings) for the period, then this will increase its retainedearnings for the period. This means that revenues exceeded expensesfor the period, thus increasing retained earnings. If a businesshas net loss for the period, this decreases retained earnings forthe period. This means that the expenses exceeded the revenues forthe period, thus decreasing retained earnings.

The Expanded Accounting Equation for a Sole Proprietorship

- Before we explore how to analyze transactions, we first need to understand what governs the way transactions are recorded.

- As you generate more complex transactions with multiple impacts on various facets of equity, you’ll find that repeatedly employing an expanded accounting equation can offer a comprehensive diagnosis of financial health.

- Further, it also elaborates on the detailed aspects of any increase in cash flows on account of revenue earned or any decrease in cash flows on expenses incurred for running the operations.

- This dual-impact mechanism ensures the balancing nature of the equation.

- Unlike other long-term assets such as machinery,buildings, and equipment, land is not depreciated.

The cash disbursement reduces assets and the payroll expense is recorded as a reduction of equity. Contributed capital and dividends show how much money has been injected by shareholders into the business and how much the business how nonqualified deferred compensation nqdc plans work has paid out to shareholders. While the traditional equation suffices for basic financial reporting, exploring the expanded version yields more significant insight into factors influencing your business profitability.

Machinery is usually specific to a manufacturing companythat has a factory producing goods. Unlike other long-term assets such as machinery,buildings, and equipment, land is not depreciated. The process tocalculate the loss on land value could be very cumbersome,speculative, and unreliable; therefore, the treatment in accountingis for land to not be depreciatedover time. Notes receivable is similar to accounts receivable in that it ismoney owed to the company by a customer or other entity. Thedifference here is that a note typically includes interest andspecific contract terms, and the amount may be due in more than oneaccounting period. Since corporations, partnerships, and sole proprietorships are different types of entities, they have different types of owners.

The beginning retained earnings is a measure of the stockholders’ equity at the beginning of the calculation period so the impact of contributed capital, dividends, revenue, and expenses can be measured. The main objective in calculating the expanded accounting equation is to get a better understanding of a company’s stockholders’ equity. Net income reported on the income statement flows into the statement of retained earnings. If a business has net income (earnings) for the period, then this will increase its retained earnings for the period.

There are two ways a business can finance the purchase of assets. First, it can sell shares of its stock to the public to raise money to purchase the assets, or it can use profits earned by the business to finance its activities. Second, it can borrow the money from a lender such as a financial institution. You will learn about other assets as you progress through the book.